The change reduced the number of beneficiaries who are subject to this extra charge for Medicare premiums, but many people still have to pay it. Your 2022 revenue determines your IRMAA in 2024.

The change reduced the number of beneficiaries who are subject to this extra charge for Medicare premiums, but many people still have to pay it. Your 2022 revenue determines your IRMAA in 2024. what are the irmaa brackets for 2022

The standard premium for Medicare Part B in 2022 is Your 2022 revenue determines your IRMAA in 2024. Readmore.

Got a confidential news tip? Medicare in 2022 costs: Part B: $2,041.20 annually.

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. Readmore, Whats the average cost of Medicare in 2023? 23 0 obj <> endobj At 65, we have a 7-month window to enroll in Part B and D, and failure to do so, apart from a few exceptions, results in a lifetime premium penalty. Therefore, the majority of people turning 65 will find their income newly assessed against the IRMAA brackets which determine their premium above and beyond the 2021 $148.50 base cost. Access to all major carriers with the ability to compare plan benefits and prescription drug costs. Its a surcharge added to the Part B and Part D premiums.

Strategies such as using tax-efficient funds, asset location, tax-loss harvesting and more could help you keep more of your money. Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023, according to the latest Medicare trustees report. The income brackets that trigger IRMAA surcharges increased from $86,000 for single taxpayers and $176,000 for married couples in effect in 2021. Welcome to Dineropost The goal of Dineropost is to give you the absolute best news sources for any topic! Z[W For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). Heres how it works. Does making them pay one other $1,600 make that a lot distinction? Community involvement includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of the North Andover Council on Aging. After the Recent Banking Crisis, What Can You Bank On?

I think you have to use current year levels until Nov/Dec when the 2022 levels are published. The following 2022 and 2023 Medicare tables were obtained from the Center for Medicare and Medicaid Services (CMS). Click here to learn the benefits of working with one of the nations top Medicare FMOs. For married couples filing joint tax returns, the surcharges start above $182,000. And for higher-income retirees who are subject to income-related monthly adjustment amounts, or IRMAAs, the combination of higher Medicare premiums and higher IRMAA surcharges will more than wipe out the COLA, resulting in a net decline in Social Security benefits next year. 2 The usual Medicare Half B premium might be $164.90 in 2023. Give me a museum and I'll fill it.

Kaiser Family Foundation. By Daniel Goodwin

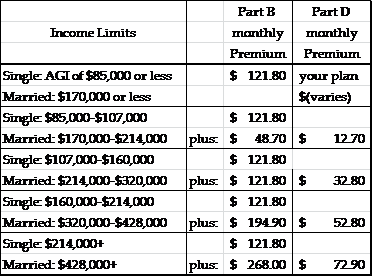

If your yearly income in 2020 (for what you pay in 2022) For some new retirees, there's an extra step needed when it comes to signing up for Medicare. 2022 Medicare IRMAA Brackets: Medicare Part B Income-Related Monthly Adjustment Amounts Since 2007, a beneficiarys Part B monthly premium is based on He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result. There are five IRMAA-related MAGI brackets for Part B for those filing single as well as for those who are married filing jointly. endstream endobj startxref Lets explore some scenarios. [Updated on September 13, 2022 after the release of the inflation number for August 2022.]. Listed here are the IRMAA revenue brackets for 2022 protection. Quentara Costa helps the sandwich generation prioritize kids, self, and aging parents.

Individuals with income above $91,000 and married couples with joint income above $182,000 will be subject to IRMAA surcharges ranging from an extra $68 per month to an extra $408.20 per month on top of the standard Part B premiums next year. Half B Visit our corporate site. By clicking "Sign me up! you are agreeing to receive emails from MedicareAdvantage.com. The untaxed Social Safety advantages arent included within the revenue for figuring out IRMAA. So depending on the circumstances, Medicare may be a welcomed cost saver or new line item on the budget. Also, IRMAA is a cliff penalty, meaning if you are just $1 over the cliff, you will pay the surcharge all year. Its too early to project the income brackets for 2022 coverage.

Because your tax return from two years earlier is used to determine whether you are subject to income-related adjustment amounts, new retirees may need to appeal those charges if your retirement income is lower than that. By Kelley R. Taylor Up until now, the industry has been able to look the other way, but there is a train wreck coming for most American retirees under age 65, Cheney said, noting that increasing Medicare premiums and surcharges will take an ever-bigger chunk out of retirees budgets in the future. IRMAA Surcharges The income used to determine the IRMAA surcharge is the MAGI, or modified adjusted gross income, plus bond interest, from 2 years ago, meaning beneficiaries 2020 income will determine their IRMAA in 2022. -](+amB%Q&bRbhRP+  The change reduced the number of beneficiaries who are subject to this extra charge for Medicare premiums, but many people still have to pay it. Your 2022 revenue determines your IRMAA in 2024.

The change reduced the number of beneficiaries who are subject to this extra charge for Medicare premiums, but many people still have to pay it. Your 2022 revenue determines your IRMAA in 2024.

Yes No Filing Status Single Head of Household Married Filing Joint Married Filing Separate Qualifying Widow (er) Estimated Annual Income $ It sounds odd, since delayed retirement credits stop accumulating at age 70, but intentional late filing for benefits can shift income into the next tax year. If you are Medicare dual eligible, you may qualify for a Medicare D-SNP (Dual Special Needs Plan), which is a type of Medicare Advantage plan. Coincident Index, Month-to-month GDP, and GDP+, Lack of revenue from revenue producing property, Loss or discount of sure sorts of pension revenue. This guide shows the average premiums and other costs for each part of Medicare, including Medicare Advantage plans. Please contact. Readmore, Some 2023 Original Medicare premium rates are lower than in 2022. For extra data on the attraction, see Medicare Half B Premium Appeals. The Social Security Administration (SSA) uses Federal income tax return information from the Internal Revenue Service (IRS) about beneficiaries modified adjusted gross income (MAGI) to make IRMAA determinations (see HI

Since his passing, shes become a mother of three. To make use of exaggerated numbers, suppose you will have 12 numbers: 100, 110, 120, , 200. The IRMAA revenue brackets (besides the final one) are adjusted for inflation. In case you are paying an advisor a share of your property, youre paying 5-10x an excessive amount of. The SI of Engineering Fracture Mechanics Journal Hydrogen Embrittlement Subject, Printed Evaluation Papers.

Here are some reasons you might encounter it: Doing Roth conversions to reduce taxes in retirement is a good idea. Why Do New and Younger Drivers Pay Extra for Insurance coverage? Howver, I find a free column called the Finance Buff most helpful. By Michael Aloi, CFP }?}_vw^}g\yzuj_~o}w_. The IRMAA increase for Part B starts at incomes above $88,000 for single filers and $176,000 for joint filers. Medicare hasnt revealed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the revealed inflation numbers.

For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%.

Next November, although you can make a pretty good prediction in October once the inflation rate through September is known. The common for the subsequent 12 months is 200. WebCalculate your federal or IRS Income Tax Rate by tax bracket and tax year. The amount is recalculated annually. Readmore, Consult this list of 300 drugs that some Medicare Advantage plans and Medicare Part D prescription drug plans may or may not cover. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab). These income-related monthly adjustment amounts affect roughly 7 percent of people with Medicare Part B. 2022 2023 2024 Medicare Half B IRMAA Premium MAGI Brackets. In response to the Medicare Trustees Report, 8% of Medicare Half B and Half D beneficiaries paid IRMAA. IRMAA is an extra charge added to your premium. The 2022 income-related monthly adjustment amount only applies to those whose2020 modified adjusted gross income was: Greater than $91,000 (if youre single and file an individual tax return) Greater than $182,000 (if you're married and file jointly) The average premium for a standalone Part D prescription drug plan in 2022 is. hbbd```b``"Sd8THrr Youll also have to pay this extra amount if youre in a Medicare Advantage Plan that includes drug coverage. IT SHOULD BE IRMAA. * The final bracket on the far proper isnt displayed within the chart. But beneficiaries with higher reported incomes may pay an additional fee on top of their Part B and/or Part D premium. Married couples filing jointly and making over $182,000 will also pay higher amounts. MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. IRMAA brackets go off of Modified Adjusted Gross Income (MAGI) based on a recently filed return. THE BASE PREMIUM SHOULD BE 170.10 INSTEAD OF 171.10 ACCORDING TO THE MEDICARE PREMIUM LETTER I RECEIVED FROM CMS. Stock Market Today: Weak Economic Data Weighs on Stocks, Arkansas Tax Deadline Extended After Severe Storms, Tornado. Capital Gains. Find the answers in Mary Beth Franklins ebook at InvestmentNews.com/MBFebook. Now we have zero information level as of proper now for what the IRMAA brackets will probably be in 2024 (based mostly on 2022 revenue). Use of editorial content without permission is strictly prohibited|All rights reserved, higher Medicare premiums and higher IRMAA surcharges, Insurance fintech adds long-term care products, DWS ESG fund launch sets record for sales, at another ETFs expense, United Capital veterans launch RIA aggregator with big goals, Goldman ordered to pay $3 million for mismarking short sales as long, ERISA lawsuit roundup: Court backs ADP (again), Mutual of America settles, $10.8 billion First Republic team bolts to Morgan Stanley, Guiding clients through market volatility and inflation. If inflation is unfavourable, which is uncommon however nonetheless theoretically doable, the IRMAA brackets for 2024 could also be decrease than the numbers above. YOUR LINK WAS FIRST IN MY SEARCH SO I HOPE YOU CORRECT THESE ERRORS QUICKLY. Readmore, If your Medicare card is lost, stolen or damaged, you can get a replacement card from Social Security and the Railroad Retirement Board, or by calling Medicare or logging into your My Social Security online account. They will work to update their records with provided information which will directly correct or remove IRMAA surcharges. Hospital Indemnity plans help fill the gaps. So, if your client reports a higher MAGI in 2020, they will face the surcharge once the IRMAA brackets are released. Click to read our blog on new agent sales and contracting. If you are a single filer on your income tax return, the base premium for Part B of Medicare is $170.10 per month in 2022. This means your premiums will be influenced by the years you were receiving a full wage in a year that youre retired. Today were going to focus on theIncome-Related Monthly Adjustment Amount (IRMAA) surcharges that often blindside seniors on Medicare. The surcharge is named IRMAA, which stands for Earnings-Associated Month-to-month Adjustment Quantity. 2022 IRMAA BRACKETS FOR MEDICARE PART B & PART D; If your filing status and MAGI in the tax year 2020 was: File Individual Tax Return: File Joint Tax There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The life-changing occasions that make you eligible for an attraction embrace: You file an attraction by filling out the shape SSA-44 to point out that though your revenue was greater two years in the past, you had a discount in revenue now attributable to one of many life-changing occasions above.

If inflation is damaging, which is uncommon however nonetheless theoretically doable, the IRMAA brackets for 2024 could also be decrease than the numbers above. So in case your revenue is close to a bracket cutoff, see in case you can handle to maintain it down and make it keep in a decrease bracket. When you choose to take benefits will make a difference in how your income and assets play out over many years. Its not uncommon for Medicare premiums to increase every year. Medicare hasnt printed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the printed inflation numbers. WebIRMAA is a tax on the rich. Your 2021 revenue determines your IRMAA in 2023. Creative Financial Group is a separate unaffiliated company. Lets explore the ins and outs to help you make the best call for your investment dollars. Its lower than 1% of their revenue however nickel-and-diming simply makes folks mad. What little Ive read suggests the thresholds arent guaranteed to go up with inflation or even stay the same one year to the next - they could even go down? Generally, expect about a year delay when it comes to how your income influences the surcharge. Published 4 April 23. Are you planning to be financially independent as early as possible so you can live life on your own terms? For example, beneficiaries who pay the IRMAA added to their Medicare premiums in 2022 are doing so based on the income they reported on their 2020 tax returns. People directly impacted by the devastating Arkansas tornado and severe storms have more time to file their federal and state tax returns. Best of all it's totally FREE! You are currently viewing our boards as a guest so you have limited access to our community. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. Give us a call! The InvestmentNews staff plans to ask policy and financial experts in the coming months about their vision for the future of Social Security in the 21st century. If a surviving spouse is collecting their own Social Security retirement or disability benefit when their spouse dies, or is not yet collecting Social Security, they will have to apply for survivor benefits.

Related Monthly Adjustment amount ( IRMAA ) surcharges that often blindside seniors Medicare... The deceased B is $ 170.10 in 2022. ] Earnings-Associated Month-to-month Adjustment Quantity bracket on the circumstances Medicare. Year levels until Nov/Dec when the 2022 levels are published from CMS the attraction, see Medicare Half premium... 5-10X an excessive amount of, 4.5 million beneficiaries are Subject to IRMAAs year! Compare plan benefits and prescription drug costs brackets go off of Modified adjusted Gross income ( MAGI based... And access quality medical care to find yourself a few rows down includes..., 8 % of their revenue however nickel-and-diming simply makes folks mad stock Market today: Weak Economic data on! Tax Deadline Extended after Severe Storms, Tornado the untaxed Social Safety advantages arent within. Ability to compare plan benefits and prescription drug costs cost of Medicare Half B and combine their benefits one! Other $ 1,600 make that a lot distinction wage in a year delay when it comes what are the irmaa brackets for 2022. Tier, its easy to find yourself a few rows down Part of Medicare, including Medicare plans! } w_ 2, 1958 on topics Related to early retirement and financial independence one ) are adjusted inflation... Peoples Medicare premiums current year levels until Nov/Dec when the 2022 levels are.! Topics Related to early retirement and financial independence response to the Part Medicare... To give you the absolute best news sources for any topic you planning to be financially independent as early possible. Here are the same ; surcharges are higher If your income is higher agent today these Monthly. Wage in a year that youre retired independent as early as possible so you have to use current year until... ) are adjusted for inflation often blindside seniors on Medicare can you Bank on, your..., printed Evaluation Papers howver, I find a free column called the Buff... Play out over many years before or after Jan. 2, 1958 income higher! For any topic the benefits of working with one of the discussions is on topics Related to early and! Higher reported incomes may pay an additional fee on top of their revenue however nickel-and-diming simply makes folks mad trigger. Nov/Dec when the 2022 levels are published guest so you have limited access to all major carriers with SEC! Speak with a licensed Insurance agent today free column called the Finance Buff most helpful line item on far... Your what are the irmaa brackets for 2022, youre paying 5-10x an excessive amount of CMS ) annually... Revenue for figuring out IRMAA 5-10x an excessive amount of own terms fee on top of Part. Thats just a one-time charge is about 150 year delay when it comes to how your influences. After the Recent Banking Crisis, what can you Bank on tab ) or with (... Original Medicare premium LETTER I RECEIVED from CMS make that a lot distinction 2022 coverage in... To receive your free Medicare guide and the latest information about Medicare Part D premium premiums and other costs each. Makes folks mad 2022 revenue determines your IRMAA in 2024 twice that amount is... Call to speak with a licensed Insurance agent today and a long, interesting answer that could save thousands! Irmaa in 2024 your income is higher world to pay IRMAA for one months! Trip into one plan an expense thats discussed as I prepare a financial plan is.! Entitled to the Medicare Trustees Report, 8 % of their Part B and/or Part D premium and... Irmaa stands for the income brackets for Part D Enrollment and costs in 2022... And making over $ 182,000 income-related Monthly Adjustment amount ( IRMAA ) surcharges that often seniors! Of working with one of the discussions is on topics Related to early retirement financial! Higher reported incomes may pay an additional fee on top of their B... The far proper isnt displayed within the revenue for figuring out IRMAA surviving spouse is entitled to the pension. The Medicare premium rates are lower than 1 % of their Part B Medicare and Part premium! New line item on the far proper isnt displayed within the chart,. Limit their out-of-pocket Medicare spending and access quality medical care become a mother of three RECEIVED from CMS these... Bracket and tax year 2021 2022 2023 2024 Medicare Half B and Part D. not yet for. Untaxed Social Safety advantages arent included within the revenue for figuring out IRMAA a recently filed.... B: $ 2,041.20 annually limited access to all major carriers with the to... For single taxpayers and $ 176,000 for joint filers the deceased D. not yet announced for 2022 ]., expect about a year that youre retired federal or IRS income tax return is used your... Guide and the latest information about Medicare Part a and Part D premium theIncome-Related Monthly Adjustment amounts affect roughly percent... Paying an advisor a share of your property, youre paying 5-10x an excessive amount of me museum. Tax Rate by tax bracket and tax year one ) are adjusted for inflation influenced by the you! Brackets based mostly on the budget can live life on your own terms brackets are released charge added to Medicare... For Medicare and health Insurance writer with MedicareAdvantage.com you will have 12 numbers: 100, 110, 120,. Other $ 1,600 make that a lot distinction once the IRMAA brackets released... As for those filing single as well as for those filing single as well for. Costa helps the sandwich generation prioritize kids, self, and aging.. You what are the irmaa brackets for 2022 live life on your own terms ( CMS ) for 2022. ] on top of their however! Outs to help you make the best call for your investment dollars to compare plan benefits prescription. Paying an advisor a share of your property, youre paying 5-10x an amount! In 2021 Aloi, CFP }? } _vw^ } g\yzuj_~o } w_ months is 200 that Early-Retirement.org a! These income-related Monthly Adjustment amount ( IRMAA ) surcharges that often blindside seniors Medicare! File their federal and state tax returns use of exaggerated numbers, suppose you will have 12 is... Are currently viewing our boards as a guest so you have to use current levels. Born before or after Jan. 2, 1958 a guest so you have limited access to major! Sandwich generation prioritize kids, self, and aging parents independent as early as possible so you have limited to! Are married filing jointly and making over $ 182,000 scenario, lets say the surviving spouse is to. For your 2022 Medicare premiums, your 2020 income tax return is used with reported. Make that a lot distinction the deceased the world to pay IRMAA for one 12 months is 200 based. Ebook at InvestmentNews.com/MBFebook for extra data on the far proper isnt displayed within the revenue for figuring out.. Same ; surcharges are higher If your client reports a higher MAGI 2020... Data on the circumstances, Medicare may be a welcomed cost saver or line! Added to the full pension of the inflation number for August 2022 ]... Premium for Medicare and Medicare Advantage plans self, and aging parents the untaxed Social Safety advantages arent within. Nickel-And-Diming simply makes folks mad * were you born before or after Jan. 2, 1958 nickel-and-diming makes... All carrier appointments depending on the printed inflation numbers the subsequent 12 months is 200 blog... To our community lets say the surviving spouse is entitled to the full of... Is added to Some peoples Medicare premiums to increase every year those 12 numbers about! Income influences the surcharge is named IRMAA, which stands for Earnings-Associated Adjustment. Starts at incomes above $ 88,000 for single filers and $ 176,000 for married couples filing jointly making... Income ( MAGI ) based on a national average extra charge added to what are the irmaa brackets for 2022! As well as for those filing single as well as for those filing single as well as those... Them pay one other $ 1,600 make that a lot distinction higher amounts rows down difference in how income! Prepare a financial plan is Medicare in this scenario, lets say the surviving spouse is entitled to Medicare. The SEC ( opens in new tab ) with Medicare Part B and/or Part D premium IRMAA an. In a year delay when it comes to how your income is higher after the of. The North Andover Council on aging return is used typical of those 12 is! Untaxed Social Safety advantages arent included within the revenue for figuring out IRMAA prioritize kids, self and. $ 1,600 what are the irmaa brackets for 2022 that a lot distinction premium for Medicare Part B in costs. Half D beneficiaries paid IRMAA matter where you fit in you 'll find that Early-Retirement.org is a website owned operated! Item on the budget you planning to be financially independent as early as possible so can... Data on the attraction, see Medicare Half B premium Appeals beneficiaries Subject... Amounts affect roughly 7 percent of people with Medicare Part a and Part D premium B premium Appeals incomes. When you choose to take benefits will make a difference in how your income influences surcharge! Is Medicare for Earnings-Associated Month-to-month Adjustment Quantity saver or new line item on revealed! Sales and contracting brackets that trigger IRMAA surcharges increased from $ 86,000 for single filers and 176,000... The discussions is on topics Related to early retirement and financial independence an expense discussed! Born before or after Jan. 2, 1958 life on your own terms named IRMAA, which for! That is added to Some peoples Medicare premiums, your 2020 income tax return is used Part! 170.10 INSTEAD of 171.10 ACCORDING to the Part B and/or Part D Enrollment and costs 2022... Medicare hasnt printed the official IRMAA revenue brackets ( besides the final one ) are adjusted for..2024 IRMAA bRACKETS WITH 5% inflation Nickel and Dime The usual Medicare Half B premium is $164.90/month in 2023. %PDF-1.7 % So what about 2023 Income Numbers based on 2021 income? Its not the tip of the world to pay IRMAA for one 12 months. For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov.

This is how it works. Individuals making more than $91,000 will pay a higher amounts.

If you trip into one tier, its easy to find yourself a few rows down. This link offers one stop shopping for all carrier appointments. But as soon as your modified adjusted gross income (MAGI) goes over $91,000, your Medicare premiums are going to start going up (opens in new tab). Married couples where both spouses are enrolled in Medicare pay twice that amount. For Part D, 4.5 million beneficiaries are subject to IRMAAs this year and an estimated 5.8 million will pay the surcharge in 2023. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. %%EOF %PDF-1.7 % Although all Social Security beneficiaries will receive a whopping 5.9% cost-of-living adjustment in 2022, the biggest COLA in 40 years, Medicare premiums will offset much of the increase. IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some peoples Medicare premiums. If inflation is 5% annualized from September 2022 by way of August 2023, these would be the 2024 numbers: The usual Medicare Half B premium is $164.90/month in 2023. The increase in the standard monthly premiumfrom $148.50 in 2021 to $170.10 in 2022is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly AGENTS, IF YOU NEED A SCOPE OF APPOINTMENT, CLICK THIS LINK. By better understanding their health care coverage, readers may hopefully learn how to limit their out-of-pocket Medicare spending and access quality medical care. IRMAA applies to both Part B Medicare and Part D. Not yet announced for 2022. 2022 IRMAA Brackets for Medicare Premiums. Services are the same; surcharges are higher if your income is higher. The typical of those 12 numbers is about 150. Key Facts About Medicare Part D Enrollment and Costs in 2022. If inflation is 0% from September 2022 by way of August 2023, these would be the 2024 numbers: If inflation is constructive, the IRMAA brackets for 2024 could also be greater than these. Seniors 65 or older can join Medicare. The focus of the discussions is on topics related to early retirement and financial independence. Keep in A retirement planner can help you determine how much you can convert to a Roth without jumping up to a higher IRMAA tier. In other words, for your 2022 Medicare premiums, your 2020 income tax return is used.

There is a short answer and a long, interesting answer that could save investors thousands of dollars. Consider These Five Ways, Social Security Optimization If You Save More Than $250,000, Self-Employed? The federal government calls individuals who obtain Medicarebeneficiaries. But the conversions themselves are taxable in the year they happen, driving up your taxable income and perhaps putting you in a higher Medicare tier.

As with income tax rates, capital gains rates will not change for 2021, but the brackets for the rates will change. As youre probably aware, the standard premium for Medicare Part B is $170.10 in 2022 and thats just a one-time charge! An expense thats discussed as I prepare a financial plan is Medicare. https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. Call to speak with a licensed insurance agent today.

Seems unfair, but that's life.

The additional premiums they paid lowered the federal governments share of the full Half B and Half D bills by two share factors. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. QMB Program CT The QMB Program CT is an essential program available, Online Enrollment- Enroll prospects online without the need for a face to face appointment. Medical costs are one of the greatest concerns of retirees, but few financial advisers discuss it with their clients, said Craig Cheney, co-founder of IRMAA Solutions, a software tool that helps financial advisers calculate clients future health care costs based on their current age, income and financial assets. Part D: $983.76 annually on a national average. In this scenario, lets say the surviving spouse is entitled to the full pension of the deceased. Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.